Everything you need to know about Solana’s winning moves

Solana, the seventh largest coin by market cap noted a staggering 311% three-monthly ROI vs USD. Solana’s more than 750% price gains over one and a half months were impressive. However, with SOL noting high weekly losses, the market’s anticipation of Solana reaching another ATH faded.

Better than the best, but struggling?

When comparing Solana’s performance to the best-performing stock (market capitalization greater than $10 billion) in 2021, it was notable that SOL’s performance was five times better than AMC Entertainment as highlighted in a Nasdaq article.

Now even though Solana looked more successful than the most successful meme stock of the year on paper, worrying signs and market-wide consolidation didn’t spare the altcoin. In fact, Solana lost the sixth spot to XRP (on market cap ranking) after noting close to a 42% price drop since its ATH.

What’s more, some other altcoins like Avalanche, Cosmos, and LUNA held much better than SOL during the recent shake-offs. Solana’s trade volumes too have dropped by almost 60% from the time leading up to its ATH. So, why was SOL struggling?

Solana’s struggle

Ethereum’s high average transaction fee that surpassed $40, along with the heightened interest in the NFT marketplace could be credited for pumping participants into the Solana network. However, with the NFT mania colling off, SOL’s rally seemed to slow down too. That coupled with the network shutdown that took place on September 14 acted as trigger points for Solana’s downward trajectory. This further gave rise to a declining positive sentiment on social media for Solana.

Solana had experienced high social anticipation over the last couple of months amid back-to-back price ATHs. However, macro-events ranging from the China-crypto ban to SOL’s network shutdown and dwindling trade volumes contributed to SOL’s struggle.

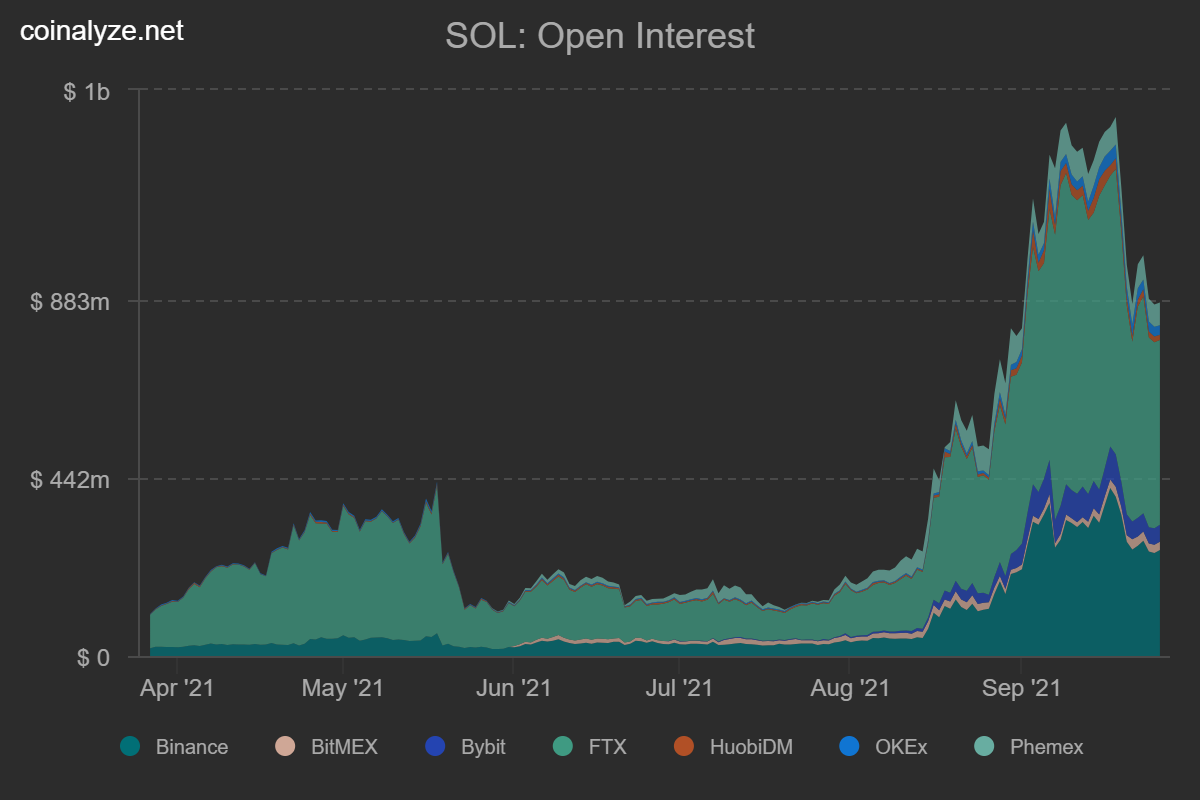

Nonetheless, despite the pullbacks, Solana’s futures market noted a high aggregate open interest (OI) of around 877 million which was a more than 600% increase in two months. While the data confirms investors’ interest, at the time of writing, SOL’s futures market had more shorts than longs. SOL shorts were around 60% while longs made 40% of the market.

But, Solana seems on the right path

While SOL traders have all the reason to fear further downside because since BTC showed no prominent moves, SOL’s growth trajectory was good in relative market terms. In fact, Coinshares’ digital asset fund report noted that institutions overlooked Solana’s struggle as the asset class registered another $4.8 million in capital inflows.

That being said, SOL noted close to 10% gains at the time of writing in just five hours, so seems like the short-term price top was not a bearish trend reversal. While some downside could be expected in the time to come, Solana does seem like it’s on the right path.