Going long on ATOM? Read this to get the full picture

- Cosmos will get EVM compatibility with the help of CantoPublic

- The number of stakers witnessed a massive hike and this could have been triggered by their new project

- The weighted sentiment against ATOM declined while its volatility increased, suggesting that buying ATOM would be riskier than usual

Cosmos, with its latest update, can expand its presence in the DeFi space in the coming future. This was affirmed by Messari, a crypto-analytics firm, after it tweeted out an update talking about CantoPublic and its alternative approach to DeFi.

2/ @CantoPublic brings EVM compatibility to @Cosmos, differentiating itself by offering its DeFi primitives as “Free Public Infrastructure”.

Canto’s model is built on three core tenets:

+Rent Extraction Resistant

+Minimal Viable User Capture

+Liquidity as a Free Public Good pic.twitter.com/sizBNSes8G— Messari (@MessariCrypto) November 8, 2022

Read ATOM’s Price Prediction 2022-2023

The CantoPublic protocol would bring EVM compatibility to Cosmos and would differentiate itself by offering DeFi primitives as “Free Public Infrastructure.” This development may help in improving Cosmos’s presence in the DeFi space.

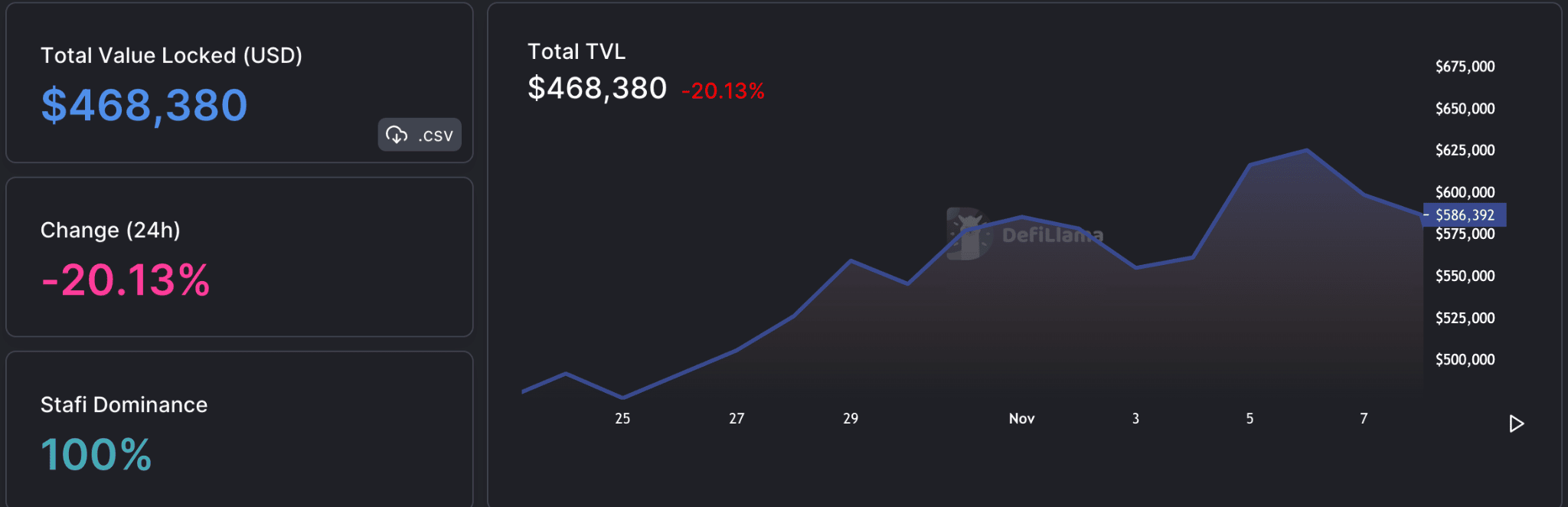

As can be seen, Cosmos’s TVL has grown over the past few weeks. At the time of writing, the total value locked by ATOM was around $468,380, after having depreciated by 20.13% in the last 24 hours.

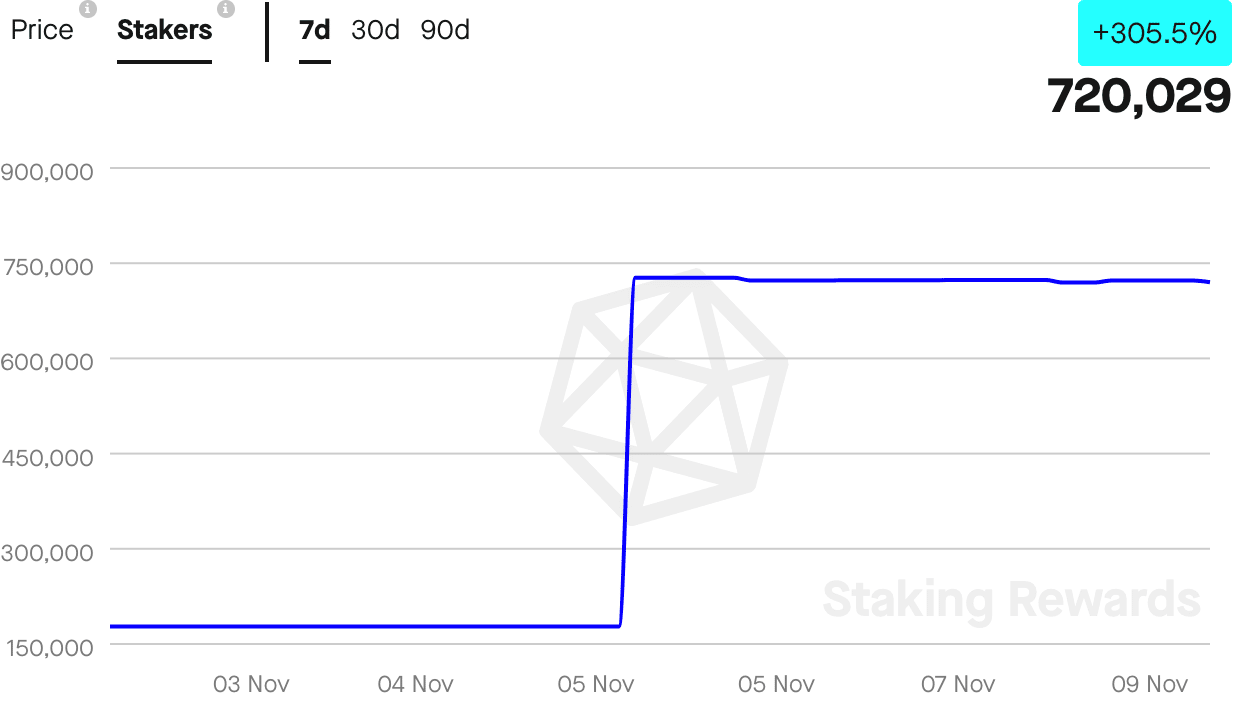

Along with Cosmos’s growth in DeFi, the number of stakers on the Cosmos network also saw massive growth over the last seven days. The same grew by an overwhelming 305%.

One reason behind the increasing interest from stakers could be their new project called Game of Chains. This project, which started on 7 November, aims to reward validators on the Cosmos network.

ATOM in a freefall

Despite hosting such events, however, the number of social mentions and social engagements for Cosmos continued to decline. According to the social analytics website LunarCrush, social mentions declined by 6.5% over the last week while social engagements decreased by 8.06%.

Weighted sentiment declined over the past week as well. The negative weighted sentiment indicated that the crypto-community had more negative than positive things to say about $ATOM of late.

$ATOM’s market cap dominance was unaffected by the negative sentiment, however, and did see some hike on the charts. In fact, at the time of writing, $ATOM had captured 0.39% of the total crypto-market.

Along with the market cap dominance, $ATOM’s volatility increased by 36.40% too, according to Messari.

At the time of writing, $ATOM was trading at $11.62, having depreciated by 11.65% over the last 24 hours.