Outlining the changing dynamics of the Ethereum-based NFT landscape

Non-Fungible Tokens, more popularly known by their abbreviated three-lettered version – NFT(s) – have soared in popularity over the last few months. Every tangent associated with the crypto-verse comes with its own question marks, often leaving people from outside the space to go, “Umm… What’s actually happening in there?”

To be honest, that was my reaction too when I first familiarized myself with the whole concept of NFTs earlier in March. Seeing people shell out abnormal sums of money just to own a piece of digital artwork initially made me laugh. Alas, the joke ended up being on me.

Well, for all of you who are still wondering what exactly is an NFT and how the dynamics of the ecosystem have been changing, here you go –

Starting from scratch

The elongated ‘non-fungible token’ version or the ‘digital token’ tag doesn’t really disentangle the whole concept. But, I’ve got you covered!

Non-fungible, as such, means something that’s unique and cannot necessarily be replaced with anything – for they differ in value. Now Bitcoin, for starters, is fungible because it can be traded for one another, and yet, every coin would retain the same value. Non-fungible items, on the other hand, are non-interchangeable and non-identical and can’t be swapped with each other – like the artwork of different artists.

The differentiating line is undoubtedly thin, but its vitality can’t be ignored.

Collecting bizarre e-collectibles, in effect, has become a hobby for some and addiction for the rest. Let me warn you, buying an NFT is not as simple as shopping online from, say, Amazon, until you get used to it.

Talking about the same to me, Avanthi TK, an NFT trader from Nagpur, India, highlighted that collectors end up spending a considerable amount of time at online NFT ‘supermarkets.’

Outlining the HODLer to trader transformation, she said,

“People initially choose to HODL their tokens as a status symbol and to flex on platforms like Twitter. However, with time, they start trading them, just like other cryptos to enjoy the fruit of returns.”

The numbers tale

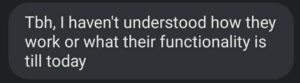

Early forms of NFTs have been around since mid-2010, but it wasn’t until recently that they started gaining traction. Recent stats with respect to the sale numbers support the aforementioned argument.

As can be seen from the snapshot attached below, the weekly NFT sales figures started rising and becoming prominently visible on the chart only since late January this year. In effect, in the weeks that followed, January ’18 and January ’20’s pre-set records were ruthlessly shattered.

Now until July, art and collectibles accounted for a major portion of the sales figures. But now, gaming-related NFTs have managed to overshadow the former category. This surge comes as no surprise because the gaming economy has, as such, witnessed tremendous growth during the pandemic.

Over the past week alone, the cumulative art and collectibles’ sales reflected a value of 86.87k while that of the gaming category corresponded to 439.7k.

Source: The Block

Interestingly, in the last 24 hours, 16 of the top 20 NFT collections witnessed price hikes that went up to 981%, while the remaining 4 collections managed to restrict their losses to under 40%.

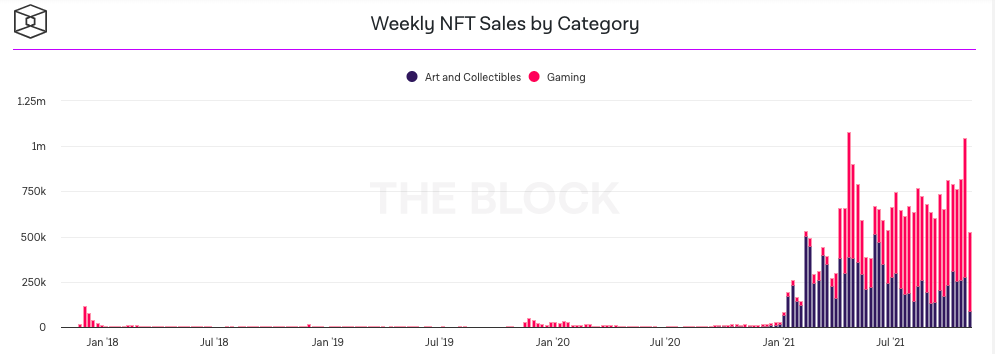

When the broader picture is viewed, however, the average price of art and collectible NFTs have witnessed a steep inclination over the months, while the price of gaming NFTs has largely been around its lows, quite away from its April spike.

Well, gaming-related NFTs have already started grabbing people’s eyeballs and sale figures now, and thus, it’s just a matter of time until they collectively soar in value too.

Source: The Block

Addressing the ‘mainstream’ debate

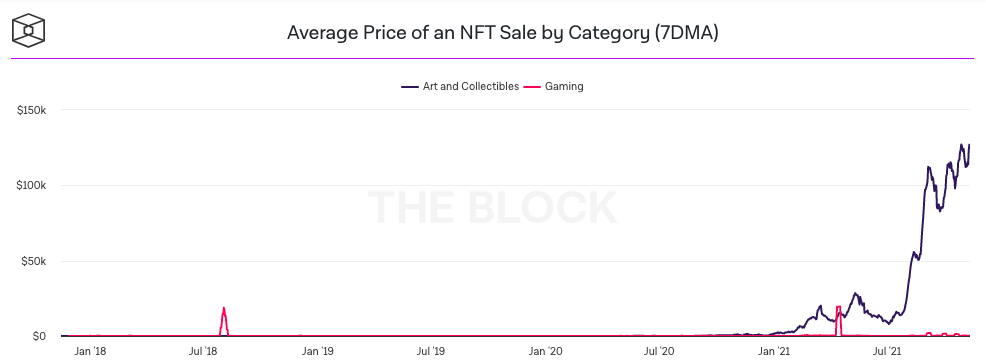

At this stage, a host of people from the community have started advocating that NFTs have become mainstream, but I don’t think so. Hardcore tech-geeks and others who have been in the crypto-space have only been playing around. The ‘common man’ has typically steered away from the whole scene.

The aforementioned statement would resonate better with people from geographies where the population is not necessarily dominated by the youth.

For instance, when I asked my dad about the NFT culture and if it’s a game-changing technology, he replied that he wasn’t really familiar with the whole concept.

As a matter of fact, technology widens the generational gap. It is nearly impossible for everyone to keep up with the advancements made in the space. In effect, people who aren’t able to catch up end up being labeled with the “outdated” tag.

The collective consciousness with respect to such tokens has, however, been increasing. In fact, at the time of writing, Google searches for NFTs had just hit a new ATH.

Source: Google Trends

Odds of winter unfolding

The grass mostly looks green, given the macro prices’ trend and the brewing interest. Nevertheless, the market might witness a slump before pumping further because there’s way too much short-term greed at the moment.

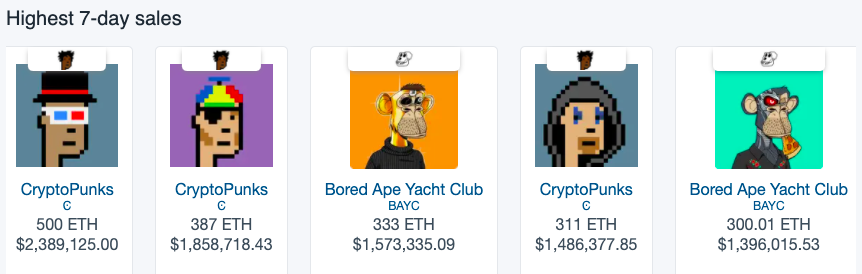

Consider this – The highest 7-day sale, at the time of writing, projected a value of over $2.3 million as per NonFungible’s data. Now, this means that someone spent around 500 ETH to buy a particular NFT. Now, that’s mindboggling, ain’t it?

Source: nonfungible.com

Well, the irresistible urge to own offbeat punks, apes, rocks, cubes, and plain text has now put sellers in a position to command a higher price for their tokens, thanks to the rapacity.

Despite hand-picked pieces doing well, it should be noted that the volume on OpenSea has started going downhill of late. A few days ago, a tweet highlighted that the largest NFT marketplace’s November volumes had not been able to go beyond 1/6th of October’s.

We are almost mid-way into November and OpenSea volumes for the month so far is only 16% of October'shttps://t.co/Hcalzp7Rid pic.twitter.com/WPDEB4ARdb

— The Block (@TheBlock__) November 13, 2021

So, has the NFT market reached its saturation point already?

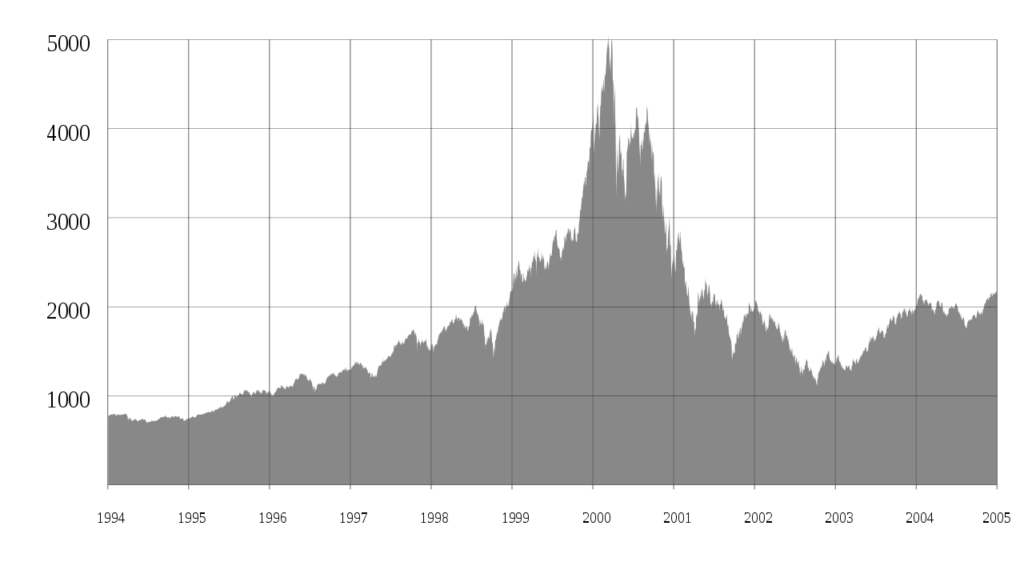

Well, the U.S. financial market witnessed something similar during the dot-com boom, or the tech bubble phase, in the late 1990s and early 2000s. Notably, the aforementioned period marked massive growth in both, the use and adoption, of the Internet.

The bubble was essentially formed because of extremely high speculation on the stocks of Internet-related companies. Between 1995 and its peak in March 2000, the NASDAQ stock market index pumped by 400%. Post that, it shed most of its value and almost nullified its gains during its “bubble phase.”

That essentially resulted in the infamous stock market crash of 2000. Post that, however, things changed, for the good. Nearly two decades down the line, the tables have turned, with the index currently revolving around the 15.8k point benchmark. In effect, the early-2000 peak now merely seems to be a plateau in front of the newly-formed mountain.

Source: Wiki

Keeping the aforementioned instance in mind, it can be contended that economic bubbles are usually formed when market participants drive the prices of assets so high that the underlying fundamentals fail to justify the hike. They’re usually formed by unlikely and overly optimistic projections about the future.

Well, it’s notoriously difficult to identify such bubbles during their initial stages, and people usually tend to come apart at the seams. For instance, during the initial few weeks of this year, when the NFT volumes remained withered, community leaders started believing that these tokens were “dead.”

Most crypto-folks, including Avanthi TK, were on the same page at that point in time. It essentially wasn’t anyone’s fault because nothing much can ever be claimed with surety about new tech. Only when the masses start depending on it and begin showing confidence, things get clarified.

Thus, looking at how things have unfolded thus far, it can be contended that the NFT market has managed to sail past its bubble phase and the current low volume epoch is likely a healthy dip.

However, post this downtrend, things are set to return back to normal quickly. And in effect, the market would continue to flourish in the future. More so because with every passing day, novel interest is emerging and making the case strong for organic and sustained growth, just like the Internet.

Changing dynamics

Evidently, a lot of eagerness with respect to NFT-related technology has emerged of late. The current state of play sees a major chunk of trading surface on Ethereum.

Well, transacting NFTs on Ethereum can turn out to be an expensive deal, owing to the gas price quotes. Now, gas is essentially the word given to the fee that’s incurred to conduct transactions or execute contracts on a blockchain platform.

It is, as such, determined by a couple of factors, including the amount of traffic on the network and the computational power taken to execute a transaction.

Now, this gas fee ensures that people who use Ethereum’s blockchain do not spam it. Until recently, the gas fee charged used to straight away go to the miners. It is directly used to incentivize them to include transactions on the blockchain. Things have, however, changed over the past few months.

The new phraseology: A refresher

Ethereum’s 1559 improvement proposal ushered in a major wave of change and the network’s transaction fee mechanism was largely altered. As a part of this upgrade, a separate base fee was introduced to each block.

The aforementioned fee payment is mandatory, programmatically determined and can’t move up or down by more than 12.5% from one block to the next.

Miner revenue today doesn’t include the base fee like before. The ETH used to pay the base fee is permanently taken out of circulation by burning it and miners are now entitled to something called a ‘priority fee.’

This fee is discretionary, determined by the user, and paid directly to the miner. Yeah, it is more or less like a miner tip.

Now, even though paying the priority fee is not mandatory on paper, participants end up paying a minimum of 1 gwei tip for their transactions to qualify for inclusion.

I mean, if no incentive is provided, would miners use up their computational power out of goodwill? Of course not!

The ‘surprising’ reality

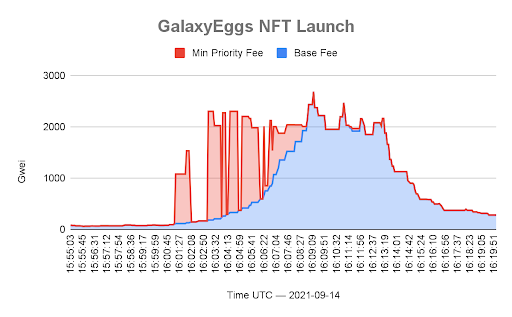

Blocknative, a global mempool data platform, in a recent Twitter thread, highlighted the changing dynamics of the gas fee during major NFT launches. Before elaborating on the findings, it is crucial to evaluate a few recent launches.

During the Galaxy Eggs NFT launch in September, the fee typically revolved around 2000 gwei. Now, if the chart attached below is closely observed, it can be noted that that the base fee was initially low and the priority fee drove the market. Post that, however, the base fee started increasing.

After the launch got over, the base fee started declining and returned back to its previous non-hype levels.

Source: Twitter

A similar trend was noted during CryptoDads‘ and Fatels‘ NFT launches too. Blocknative’s thread noted,

“In major NFT launches, the priority fee surges first and then drives the base fee up. The two combine to create a tabletop, usually around 2000 GWEI.”

On normal days when no launches are scheduled, the average fee typically revolves around the 100 gwei bracket, with the priority fee not exceeding 3 gwei.

Source: Etherscan

Concluding words

Okay, this piece has almost come to an end and I’m glad that I don’t have to key in ‘NFTs’ over and over again. Anyways, here’s what I think the future holds for the NFT marketplace –

The success of community-based NFT projects, to a fair extent, has already given a hint as to what might be next. NFTs aid people to create, build, and encash on novel forms of ownership – Making it a win-win for creators, buyers, sellers, traders, collectors, developers, and everyone else under the same umbrella.

Just like any crypto-coin, the value of NFT tokens also comes from the shared agreement of market parliaments and is, in effect, governed by the demand-supply laws. The more people increase their engagement and talk about such tokens on digital media, the more value can be imposed and the broader marketplace would, in most likelihood, prosper.

The fee dynamics have, of course, changed since the inception of NFTs and if the transaction fee on the Ethereum network ends up rising in the future, we might witness a blockchain shift. In such a case, networks like Solana, Fantom, and Avalanche could step up.