Reasons why Solana [SOL] holders can still consider going long

![Reasons why Solana [SOL] holders can still consider going long](https://ambcrypto.com/wp-content/uploads/2022/12/mohamed-nohassi-odxB5oIG_iA-unsplash-e1669986702220.jpg)

- Solana’s affiliation with FTX and Alameda has shaken the network in recent weeks.

- Solana NFTs and dApps have, however, been giving the network some hope of stability and user growth.

Solana has been going through a hard spell recently, largely in part due to its associations with FTX and Alameda. As a result, it has taken some hit, with some worrying that this could spell its doom.

Read Solana’s [SOL] Price Prediction 2022-2023

However, Solana appears to be fighting back, at least regarding the ecosystem. These new events suggest that the ecosystem is giving the network a boost in its efforts to become stable again.

NFTs witness continuous rally

Solana’s cheap gas and quick service made it a popular choice among builders, especially NFT builders. This stimulated the growth of numerous successful NFT projects on the platform.

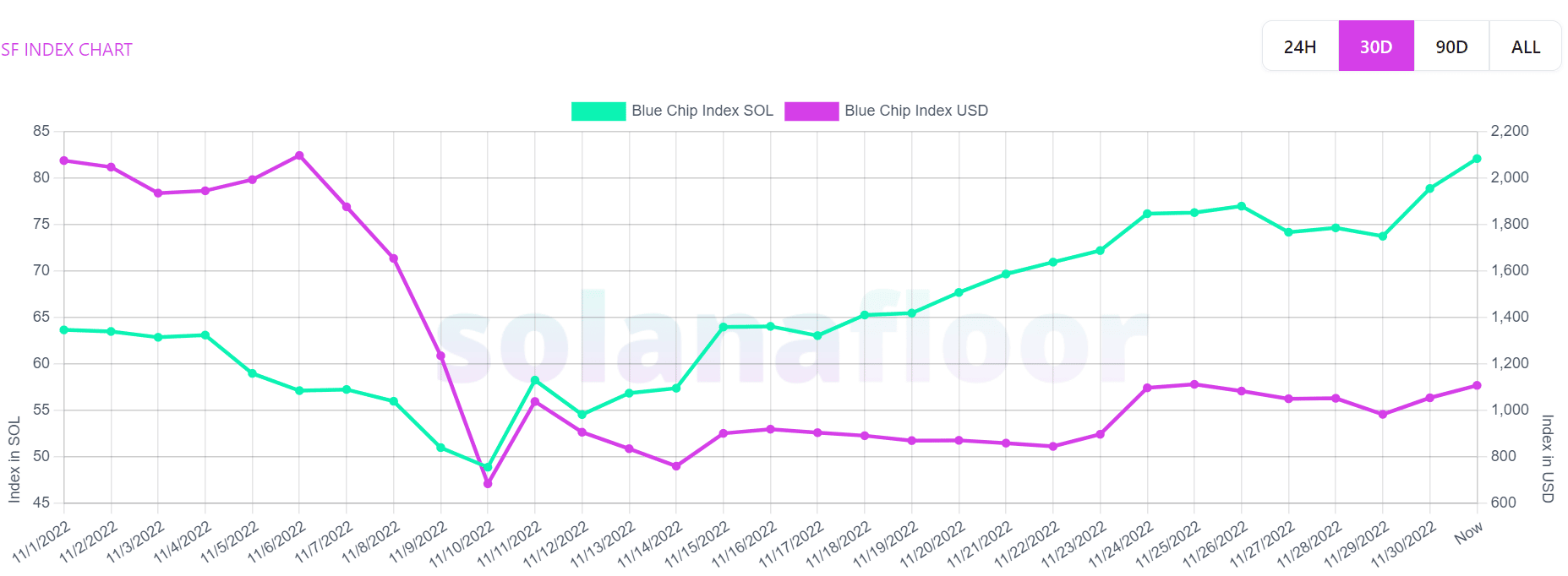

According to statistics by Solanafloor, these NFT trades were still ongoing. The average daily volume of transactions on Solana NFT rose by 67.7%, while the blue-chip index increased from 28.9% to 82.109%.

The Solana floor index chart likewise demonstrated the upward trend that blue-chip NFTs had been experiencing. Although the chart showed a fall earlier in November, it recovered and was now upward.

Some of the well-known NFTs on the Solana platform include Yoots and DeGods. The top nine NFTs on the Solana platform had shown an increase in some important indicators during the previous 30 days, according to data from DappRadar.

For instance, Yoots NFT saw a 274.87% rise in volume, a 290.7% increase in traders, and an over 500% increase in sales. The other NFTs in the top nine NFTs, according to DappRadar, all had a rise in these indicators by varying proportions.

This merely demonstrated that these NFTs’ popularity and profitability persisted despite problems with the Solana network.

Fiat-for-crypto feature comes to Solana dApps

Stripe, a payment processing company, has launched a program to help businesses make and receive payments in cryptocurrency. The news was first shared with the public in a statement released by Stripe and Solana on 1 December.

The product is a widget that can be modified and integrated into a Web 3.0 app, DEX, NFT platform, wallet, or dApp, allowing users to buy coins immediately. Solana is the location for eleven of the company’s sixteen initial developments.

1/ @Stripe debuted its fiat-to-crypto payments onramp — and 11 of the 16 projects in the program are built on Solana ?@AudiusProject@xNFT_Backpack@FastAF@fractalwagmi@glowwallet@MagicEden@magic_labs@orca_so@ottrfinance@spotwallet@UltimateMoneyhttps://t.co/F8uNupoucQ

— Solana (@solana) December 1, 2022

Users can now purchase tokens such as USDC and SOL with fiats.

SOL in a daily timeframe

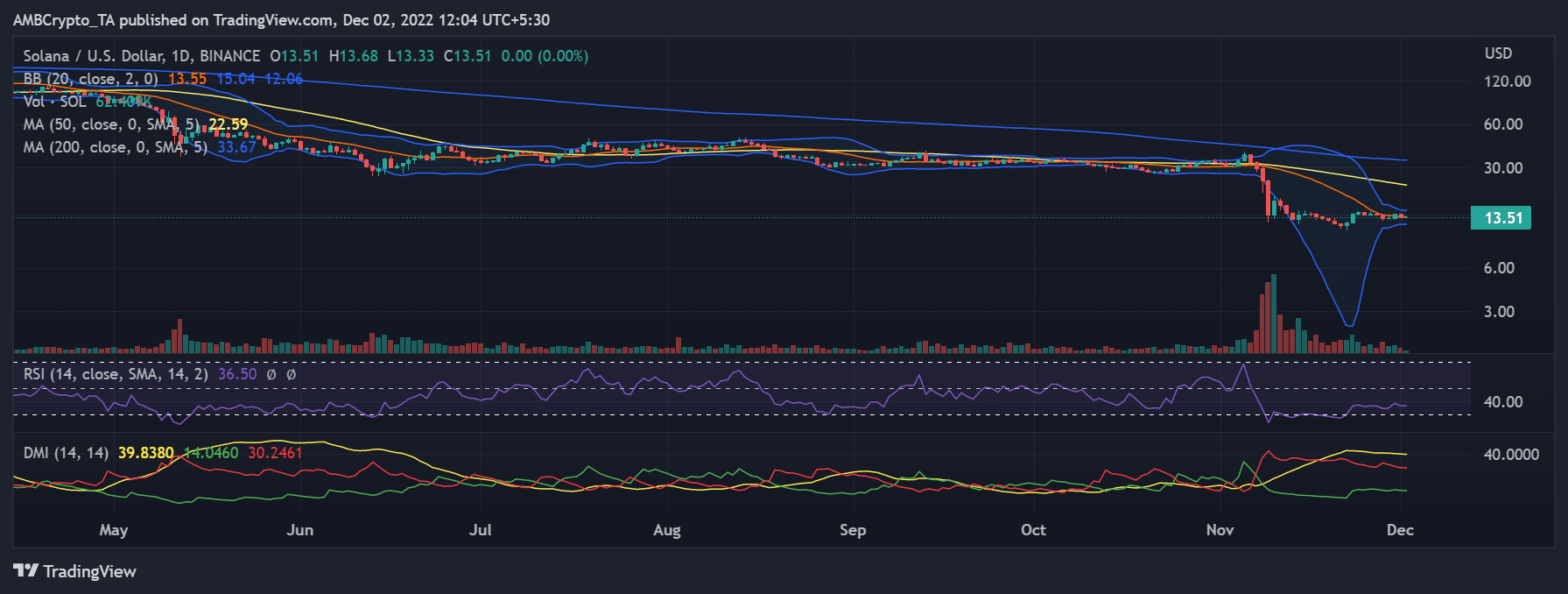

A daily period analysis of SOL revealed that the news had no discernible impact on the asset’s price movement. The asset had lost nearly 5% over the preceding trading period. At the time of writing, SOL was trading at about $13.

Solana is receiving continual support from the NFT space, which shows confidence in the network. The network may see an increase in users due to recent developments with Stripe and its dApps.

Although the ecosystem may have suffered, the ecosystem was working furiously to ensure the network returns to normal. After achieving this, SOL could also experience high stability.

![Solana's [SOL] high fee generation figures are misleading - Here's why!](https://ambcrypto.com/wp-content/uploads/2025/05/B6ACB721-6173-4255-91A4-FEE8D9DE21D1-400x240.webp)