STEPN to be a part of your Q4 portfolio? You may want to read this first

STEPN [GMT] registered approximately $10.36 million in profit in Q3, which would be a 90% drop from its Q2 earnings. The decline in profits could be attributed to STEPN’s declining number of users and activity.

However, given the drastic drop in the token’s Q3 performance, it only remains to be seen whether STEPN would swing with the festivities of Q4.

__________________________________________________________________________________________

Here’s AMBCrypto’s Price Prediction for STEPN for 2022-2023.

__________________________________________________________________________________________

STEPN down from the throne

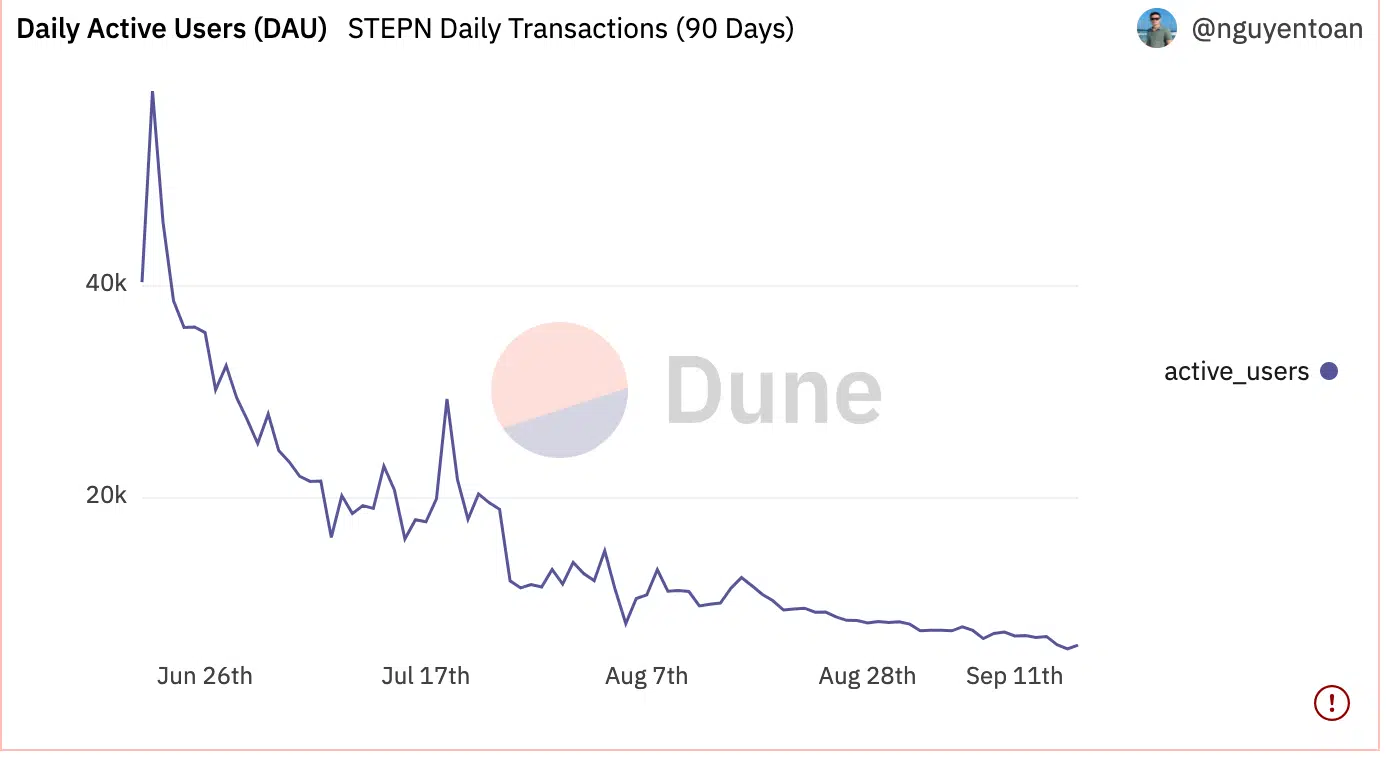

One of the main concerns for the GameFi application would be its declining number of daily active users. The number of daily active users for STEPN witnessed a steady decline since the end of June. This was evident from the chart given below.

The decline began at the beginning of the third quarter, and the number kept depreciating since. This update could be one of the reasons for GMT’s poor performance in Q3.

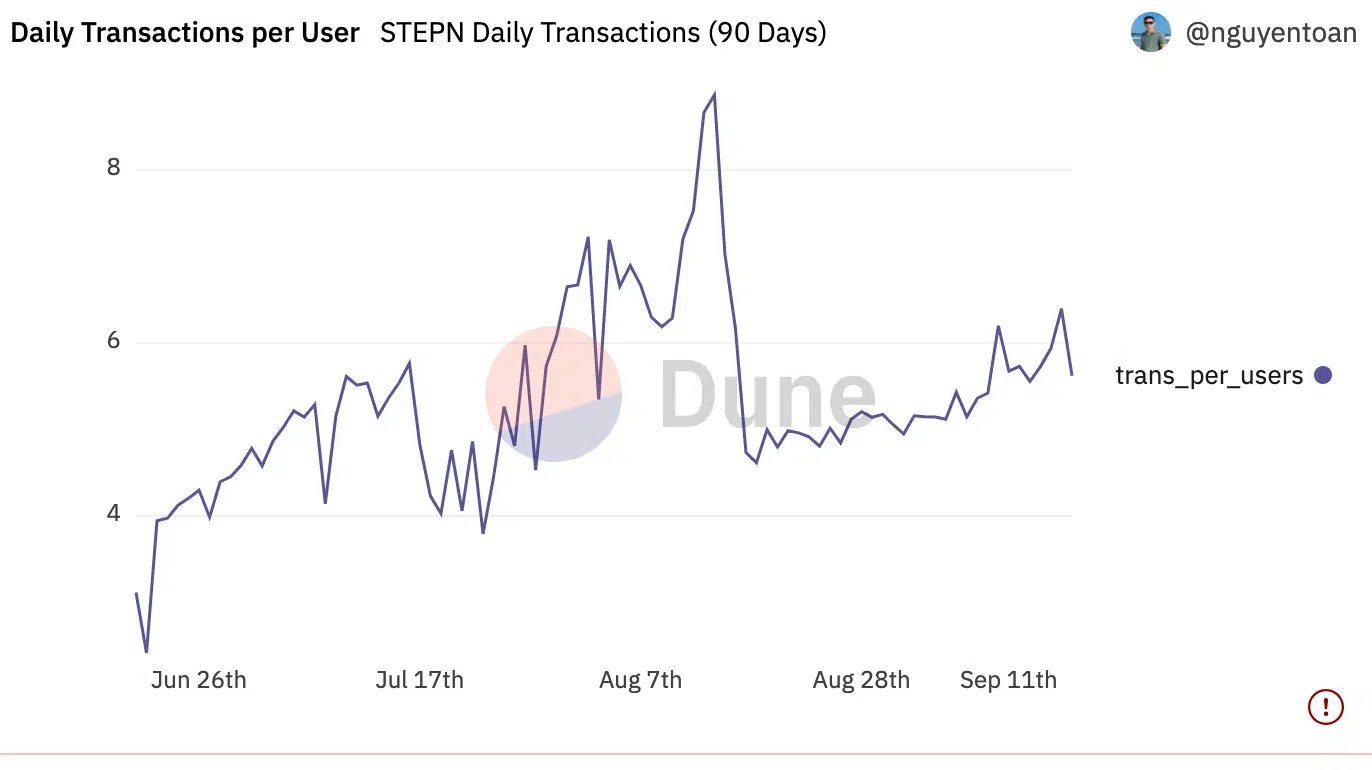

Even though the number of daily active users declined, the number of transactions on the network witnessed a surge over the past 90 days. As can be witnessed from the image below, despite some volatility, the number of transactions per user showed growth over the past quarter.

Additionally, despite STEPN’s dwindling price and daily active users, the network did witness some steady movements. Users that relied on STEPN and continued with their daily transactions may be the key for STEPN’s growth.

It’s never all bright and sunny…

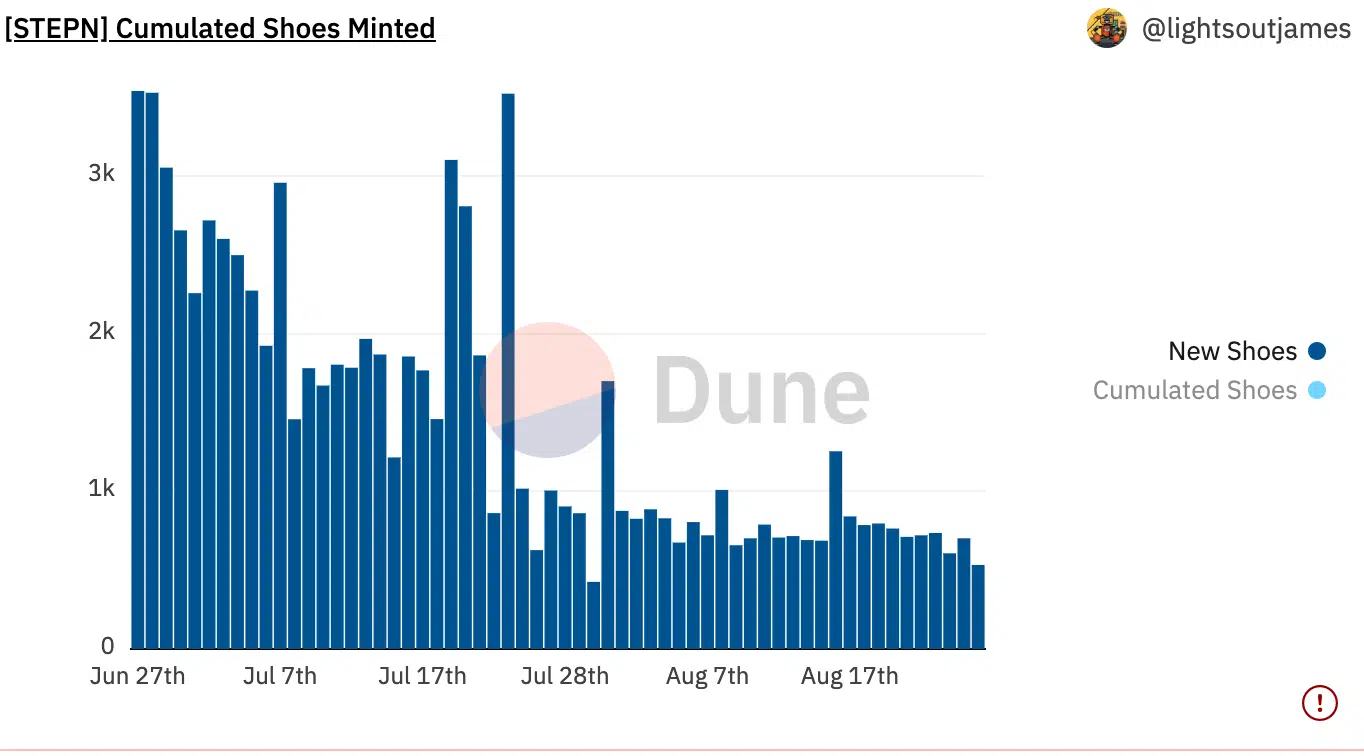

Despite a positive update on the user front, there were still major concerns about the network. The STEPN ecosystem is majorly driven by its NFT shoes, which users purchase on its marketplace and use to earn tokens and NFT prizes.

The decline in the number of shoes minted could be an indication of a reduction in demand for the STEPN NFTs. The same could be witnessed in the chart given below.

In addition to the aforementioned information, the network’s social media mentions and engagements also dropped since September.

According to LunarCrush, a social media analytics firm, STEPN’s social media mentions dropped by 28% since September. Furthermore, social engagements depreciated by 18% as well.

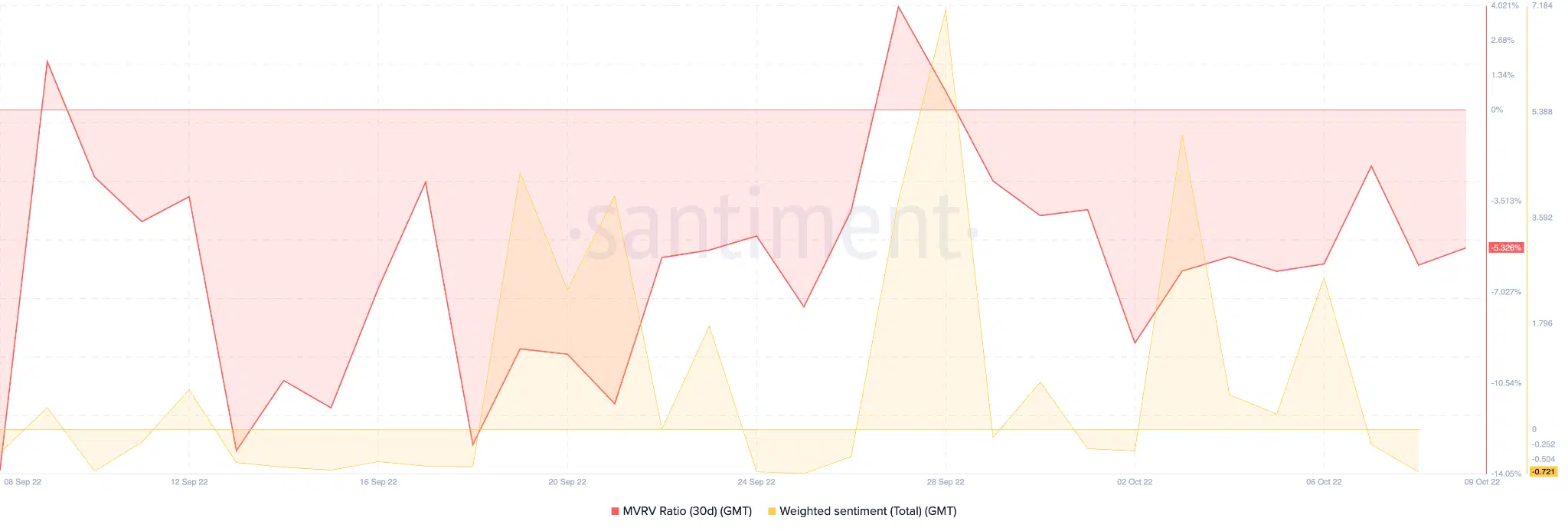

Adding to the downfalls was the weighted sentiment for the GMT token. The weighted sentiment witnessed a decline over the past few days. Furthermore, GMT’s Market Value to Realized Value (MVRV) ratio also declined over the last two weeks, implying a bearish future for the token.

At press time, GMT was trading at $0.6429 and depreciated by 0.37% in the last 24 hours. Its volume depreciated by an alarming 84% and its market cap declined by 0.31% since 8 October.

Investors looking to short GMT could have a look at STEPN’s tokenomics which could also have an impact on their trades.