Uniswap: Is whale interest enough to change UNI’s current price trajectory?

- UNI was among the cryptos that the top 500 ETH whales were holding, at press time.

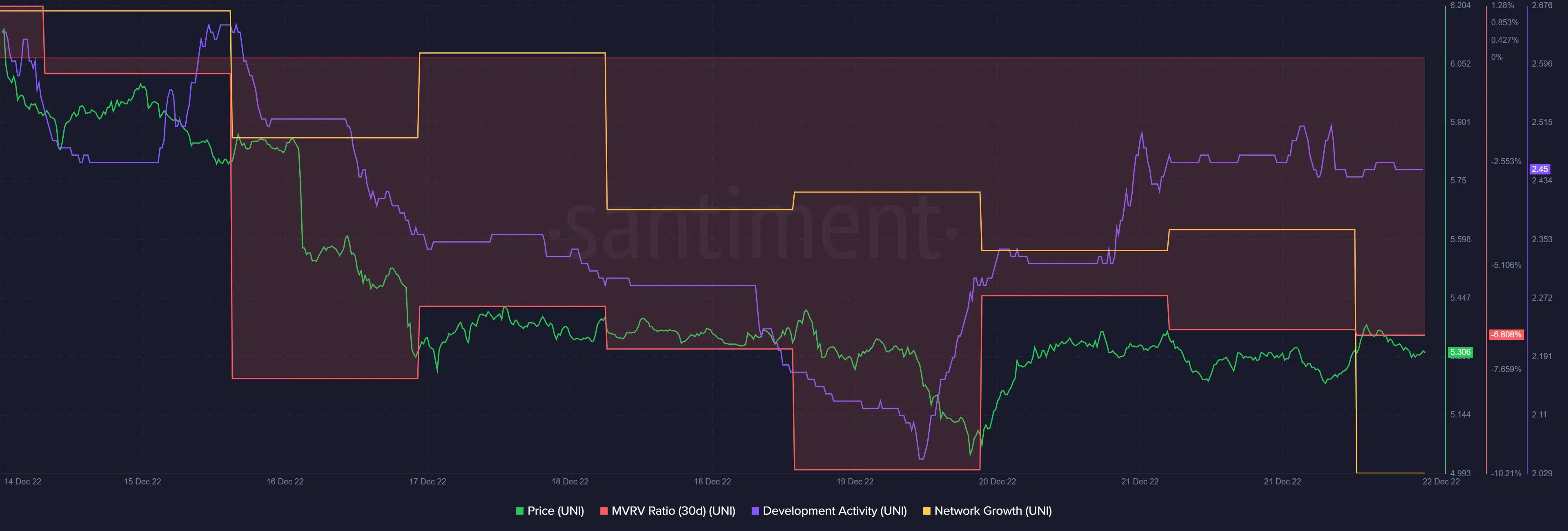

- MVRV Ratio registered an uptick but indicators were bearish.

During this ongoing crypto winter, most of the cryptos have been struggling to increase their values, and Uniswap [UNI] was also among them. However, despite its underwhelming performance, UNI received notable interest from the whales.

WhaleStats, a popular Twitter handle that posts updates related to whale activity revealed that UNI was one of the cryptos that the top 500 Ethereum whales were holding.

At press time, UNI’s price was down by more than 10% in the last seven days and was trading at $5.30 with a market capitalization of over $4 billion.

? The top 500 #ETH whales are hodling

$50,277,387 $SHIB

$41,484,557 #UnknownToken

$39,156,179 $UNI

$34,434,948 $BEST

$33,863,152 $BIT

$31,971,922 $LOCUS

$31,095,141 $MATIC

$20,592,269 $cbETHWhale leaderboard ?https://t.co/tgYTpOm5ws pic.twitter.com/llWv8ykKbv

— WhaleStats (tracking crypto whales) (@WhaleStats) December 21, 2022

Read Uniswap’s [UNI] Price Prediction 2023-24

What is working in UNI’s favor?

Interestingly, Uniswap was also on the list of the top DeFi projects in terms of fees and revenue generated on the Polygon network in the last 24 hours.

A look at UNI’s on-chain metrics provided some information as to why it managed to remain popular among the whales. For instance, UNI’s MVRV ratio registered a slight uptick, which is a positive signal for a network.

Moreover, the development activity registered growth over the last week, reflecting the high efforts of the developers in improving the blockchain.

CryptoQuant’s data revealed that UNI’s exchange reserve was decreasing, suggesting less selling pressure. UNI’s active addresses were also on the rise, which is yet another green signal. Nonetheless, UNI’s network growth chose to move southward, which was bearish.

How many UNIs can you get for $1?

The bears are still winning

Surprisingly, things may not be as good as they look because the market indicators were in the bears’ favor.

UNI’s Chaikin Money Flow (CMF) went down considerably, which is a development in the sellers’ interest. The Exponential Moving Average (EMA) Ribbon and the MACD also revealed bearish advantages in the market, reducing the chances of a price surge any time soon.

Nonetheless, UNI’s On Balance Volume (OBV) was resting in quite a high position, which looked promising for the long-term holders.