Why Hedera [HBAR] should be on your watchlist in 2023

![Why Hedera [HBAR] should be on your watchlist in 2023](https://ambcrypto.com/wp-content/uploads/2023/01/network-gfde5a3dd9_1280.jpg.webp)

- Hedera is set to tap into growth as the world pushes for more energy-efficient and environmentally friendly solutions.

- HBAR bulls put up a strong defense against the resurgence of sell pressure.

The Hedera blockchain describes itself as the cleanest blockchain in terms of energy consumption. We saw a deep push for efficiency in 2022 and this trend is likely to continue, which is why HBAR enthusiasts should take note of the latest updates regarding the network.

How many are 1,10,100 HBARs worth today?

Avery Dennison, one of the most important material sciences companies in the world confirmed Hedera’s attendance at World Economic Forum this year. The same company is currently one of Hedera’s partners, which means the network is already attracting partners that are aligned with the WEF’s efficiency and sustainability plans.

Avery Dennison is proud to join our partner Hedera at #WEF23 in Davos. Michael Colarossi, Pascale Wautelet, Neil Hay and Kamila Kocia to share our https://t.co/EqzdfELHK4 technology and discuss solutions regarding efficient #supplychains, reducing #waste and driving #circularity. pic.twitter.com/lT2D1cH8kF

— Avery Dennison (@AveryDennison) January 14, 2023

It should be interesting to see what Hedera has planned this year as far as sustainability is concerned. We may see more partnership announcements made during the upcoming WEF23 event. Especially partnerships that may help support Hedera’s growth in 2023.

The announcement also highlights Hedera’s push towards partnerships in key industries aligned with the sustainability agenda. These areas might drive organic adoption in the future, putting HBAR on the fast track for robust growth.

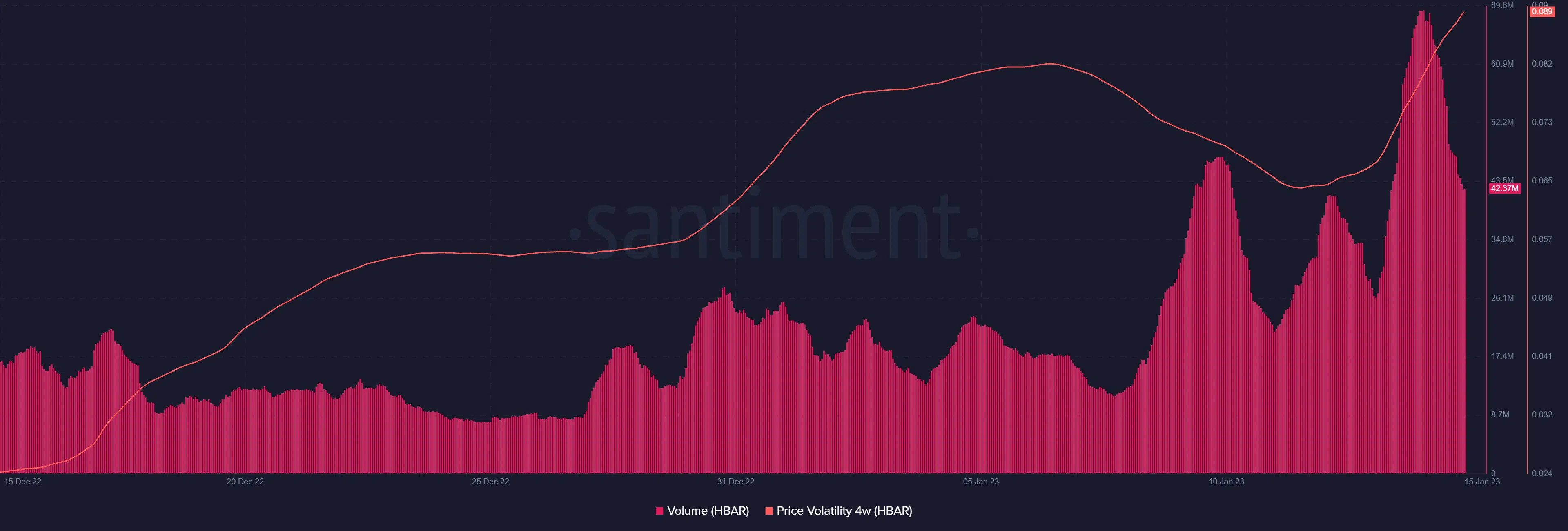

HBAR has seen a surge in demand as well as price in the first two weeks of January after previously crashing hard in 2022. The cryptocurrency just concluded a 49% upside in the last two weeks.

HBAR bears are turning up the heat

The last 24 hours have been characterized by a surge in sell pressure. However, there is still a lot of buying volume in the market, hence the cryptocurrency is holding on to its gains despite being overbought. One potential reason is that it is still experiencing some demand courtesy of the recent volume spike.

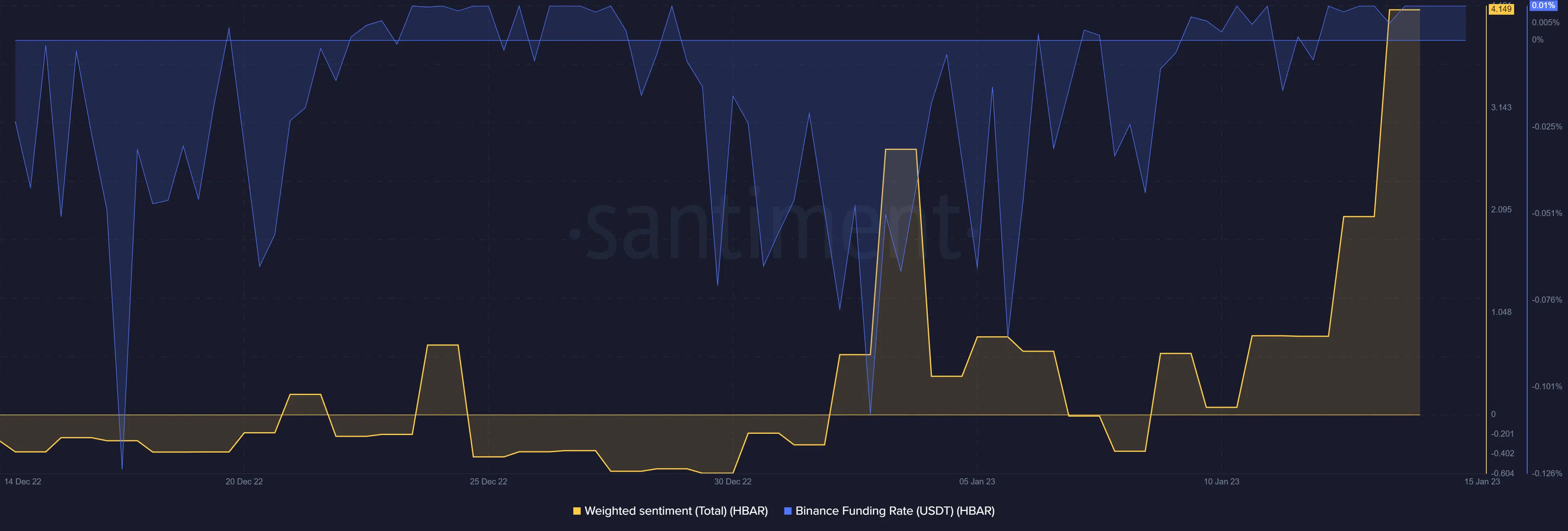

HBAR’s volatility metric indicates an injection of renewed momentum towards the end of the second week of January. This contributed to its sustained trajectory. It also helped that HBAR’s weighted sentiment had a sharp uptick towards the end of last week. An indication of strong demand.

The weighted sentiment surge reflects strong demand for HBAR in the derivatives market. This was demonstrated by the upside in HBAR’s Binance funding rate.

Current bearish expectations for HBAR have been sized up by the bulls. It experienced a weak bearish momentum especially now that the market is demonstrating resistance against the downside. Nevertheless, HBAR’s long-term potential in 2023 looks promising.