LTC celebrates key milestone but is it enough to bring back bullish confidence

It is now more than a decade since Litecoin (LTC) was founded and it has come a long way since then. The network’s latest update reveals the extent of Litecoin’s achievements while underscoring the healthy growth it has achieved so far.

Here’s AMBCrypto’s price prediction for Litecoin (LTC)

Litecoin is celebrating its 11th year of existence and it has also revealed that it managed to secure over 133 million transactions. The update also noted that the network managed to achieve that milestone without any downtime.

As of today, the Litecoin Network has processed well over 33,000,000 transactions in 2022.

11 years of continuous immutable, uncensorable, flawless uptime and a wonderful end to the year!#Litecoin ⚡ pic.twitter.com/aQ1LTdtT6M

— Litecoin Foundation ⚡️ (@LTCFoundation) November 8, 2022

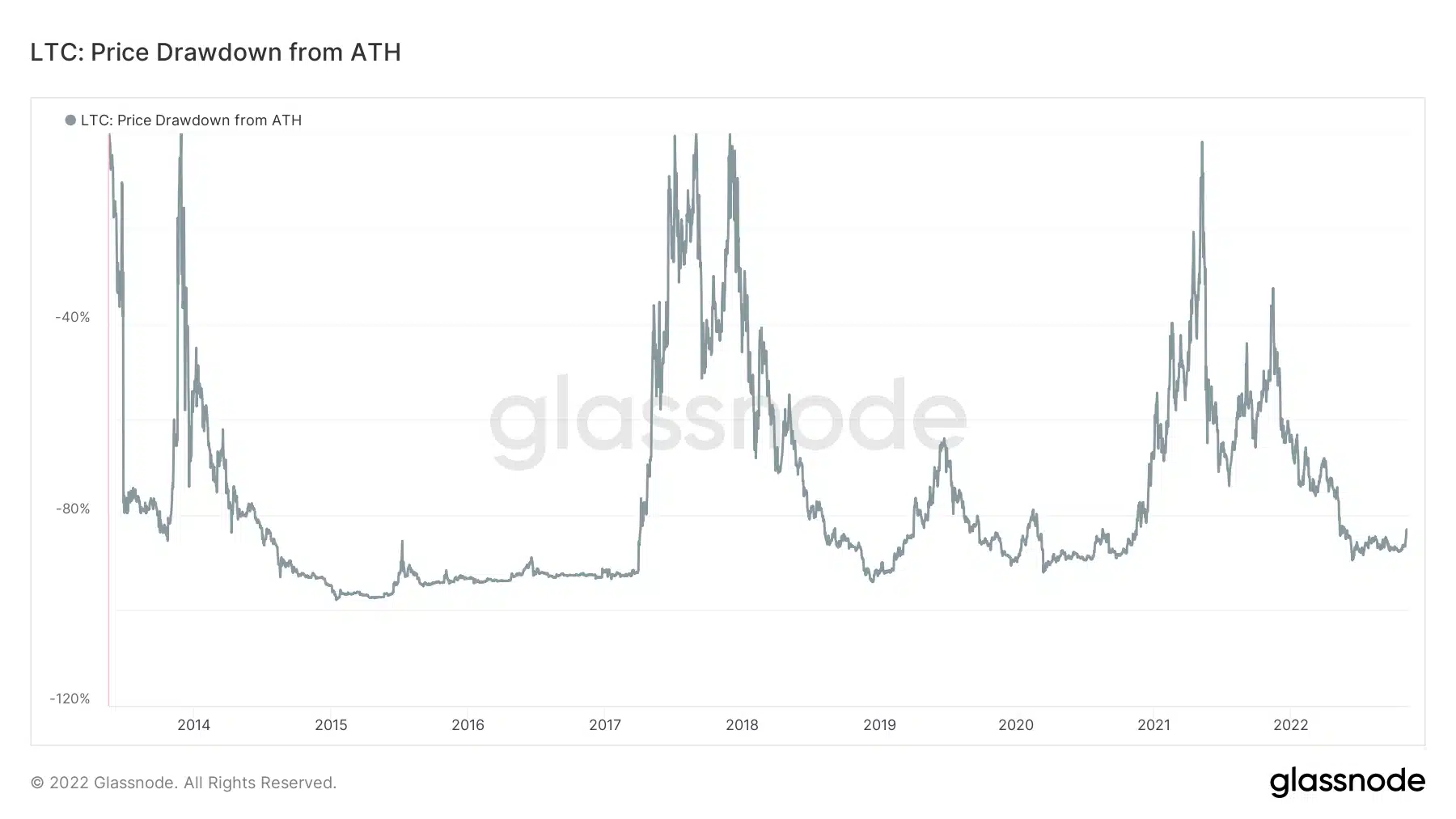

The milestone is a testament to the Litecoin network’s efficiency and health. However, this has not stopped LTC from experiencing market headwinds. The cryptocurrency is currently at an 83% drawdown from its historic high.

The 2022 bear market is not the first time that LTC has been heavily drawn down. The first was between 2014 and 2015 while the second major drawdown occurred between 2018 and 2019. As far as LTC’s latest price action is concerned, it managed to pull off a 50% upside from its October lows, in an attempt to exit the lower range.

LTC’s latest upside was capped at $73.36 after soaring into overbought territory on Monday (7 November). The return of sell pressure especially in the last two days triggered a retracement to its $64.76 press time level.

In fact, LTC has notably demonstrated some buying pressure in the last 24 hours despite the pullback. This might be a sign that the recent update has influenced investors’ sentiment, potentially cushioning Litecoin from more sell pressure. But is it enough to support a recovery back above $70?

Where is Litecoin headed next?

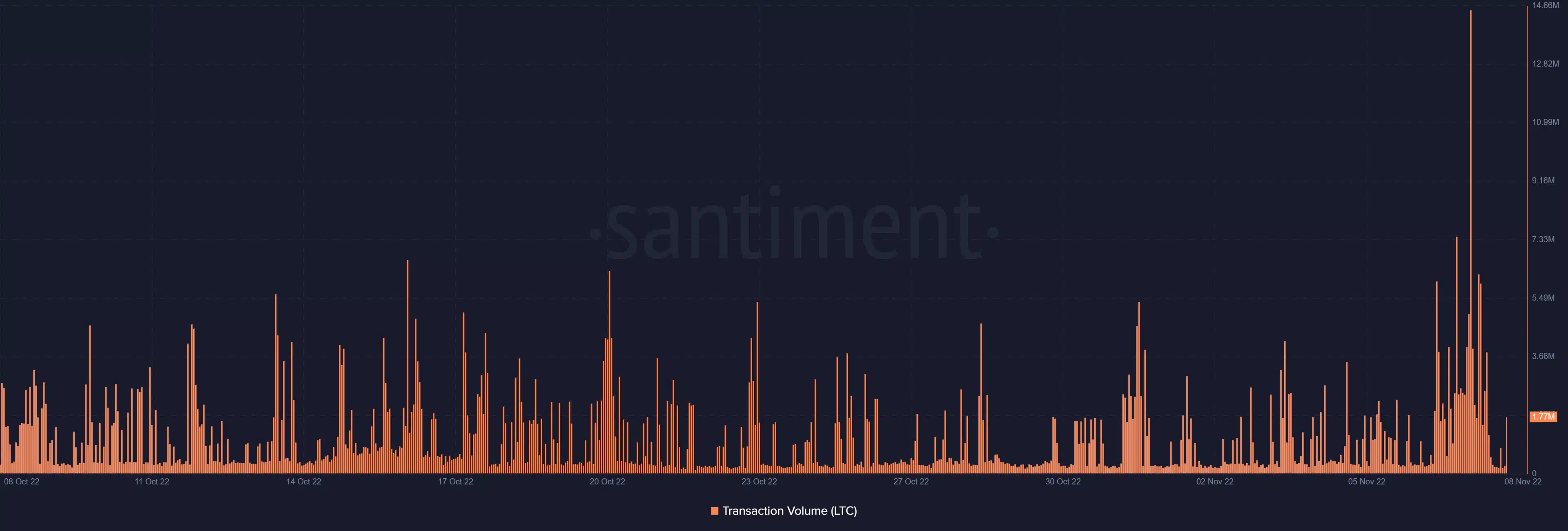

Litecoin maintained its transaction volume for the last four weeks near the five million range. However, we observed a sudden spike in transaction volume this week, with the transaction volume soaring as high as 14.51 million LTC in the last 24 hours.

This surge in transaction volume is likely a reflection of the surge in sell pressure. A look at Litecoin’s circulation metric reveals a similar outcome.

We saw a surge in the circulation metric in the last seven days, resulting in a new weekly high. However, the same metric indicated a pivot since Sunday (6 November).

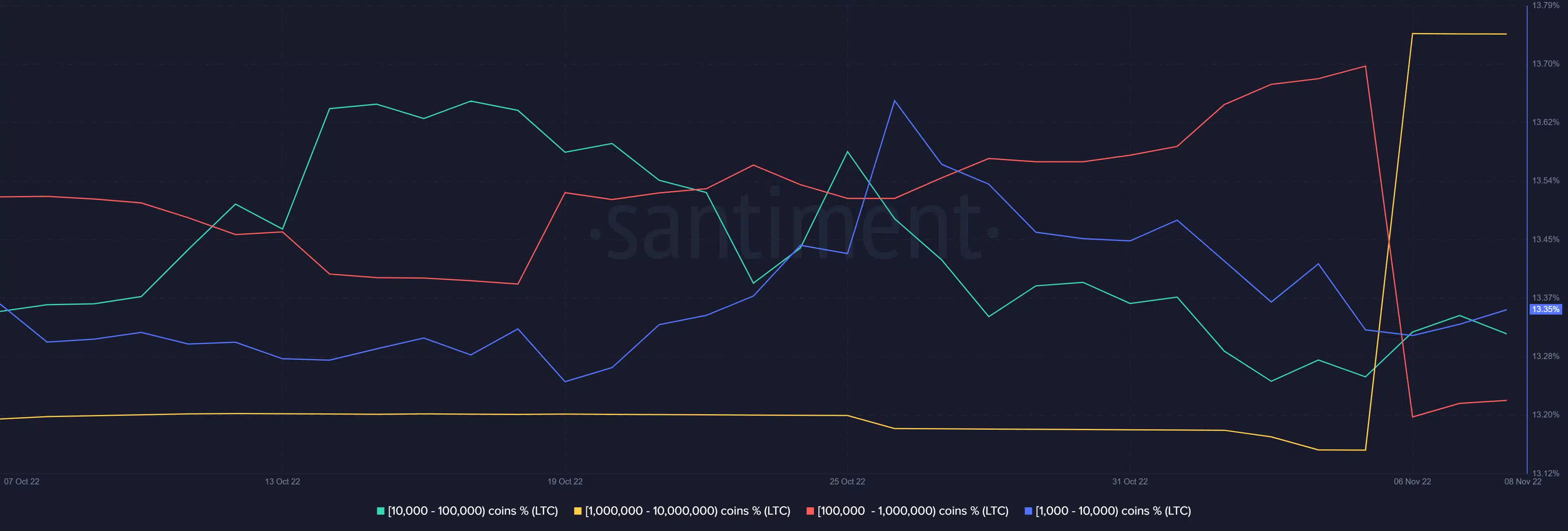

Litecoin’s supply distribution provides a better view of what the top addresses or whales have been doing. LTC’s largest addresses holding over one million coins registered a sizable increase in their balances on 5 November. However, this incoming buy pressure tapered out the next day (Sunday).

Addresses holding between 1,000 and 100,000 also increased their balances at the same time. Meanwhile, addresses holding between 100,000 and one million LTC were taking profits.

Most of the top whale categories have leveled out, meaning they are not selling or buying. This might result in a limited downside for Litecoin. Nevertheless, the market remains highly unpredictable, which means there is still more room for downside.