Decoding the ‘Lido on Solana V2’ update for LDO’s long-term holders

- Lido announced a new upgrade that would improve the user experience for Solana stakers.

- Despite new upgrades, the number of users on the protocol continued to decline.

In an announcement on 21 December, Lido Finance [LDO] stated that it made new upgrades to its technology.

Lido updated to V2 on the Solana [SOL] network. However, despite these changes, Lido’s market conditions still looked weak.

Lido on Solana v2 is live!

We have successfully updated the protocol to v2 with the major change being the removal of the dedicated 100% commission in favor of public validator nodes with a maximum commission of 5%.

A new chapter is opened.https://t.co/Jy34HgV2zV

— Lido (@LidoFinance) December 21, 2022

Read Lido’s [LDO] Price Prediction 2023-24

New changes to Lido Finance

This new update would remove 100% of all commission nodes from the pool. Along with that, it would improve the state of validators on Lido, as they would receive both their block rewards and staking rewards in SOL instead of stSOLb (Staked Sol).

The Lido network would be more secure for users who want to stake their SOL and more profitable for node operators.

Although Lido’s team was consistently changing its protocol, there were still areas where Lido needed to improve.

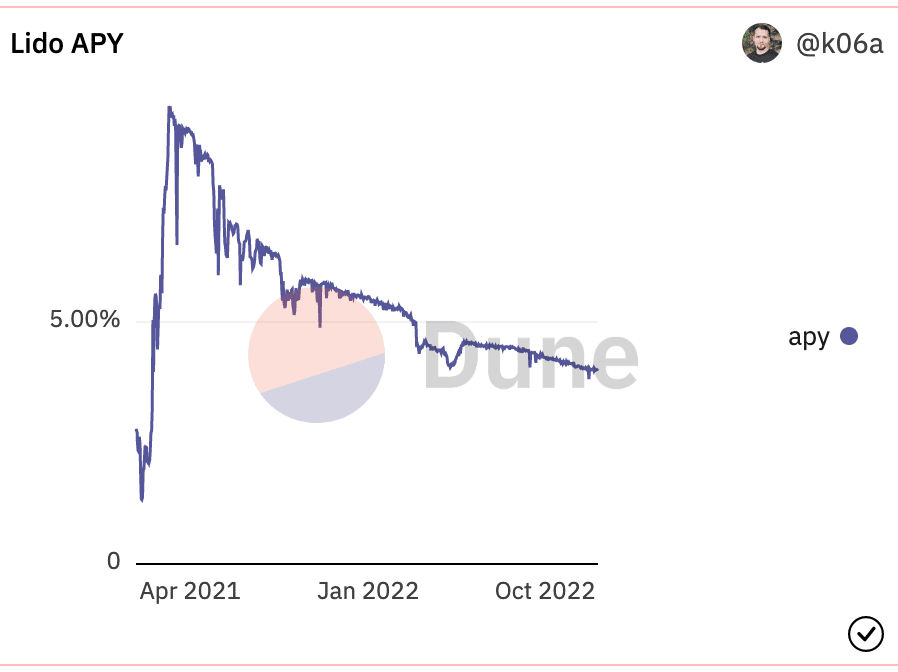

For instance, the APY (annual percentage yield) for Lido decreased materially over the past. From the data provided by the Dune Analytics dashboard, it was observed that the APY generated by Lido for its users had declined from 5.42% to 3.99% at the time of writing.

This declining APY could be one reason why the number of unique users on the Lido protocol decreased. According to data provided by Messari, the number of unique users on the Lido protocol had fallen by 20.86% in the last 30 days.

The decreasing number of users on the protocol ended up impacting the revenue generated by Lido. Its total revenue decreased by 18.82%, and at the time of writing, the protocol’s total revenue was $26.56 million.

The market reacts

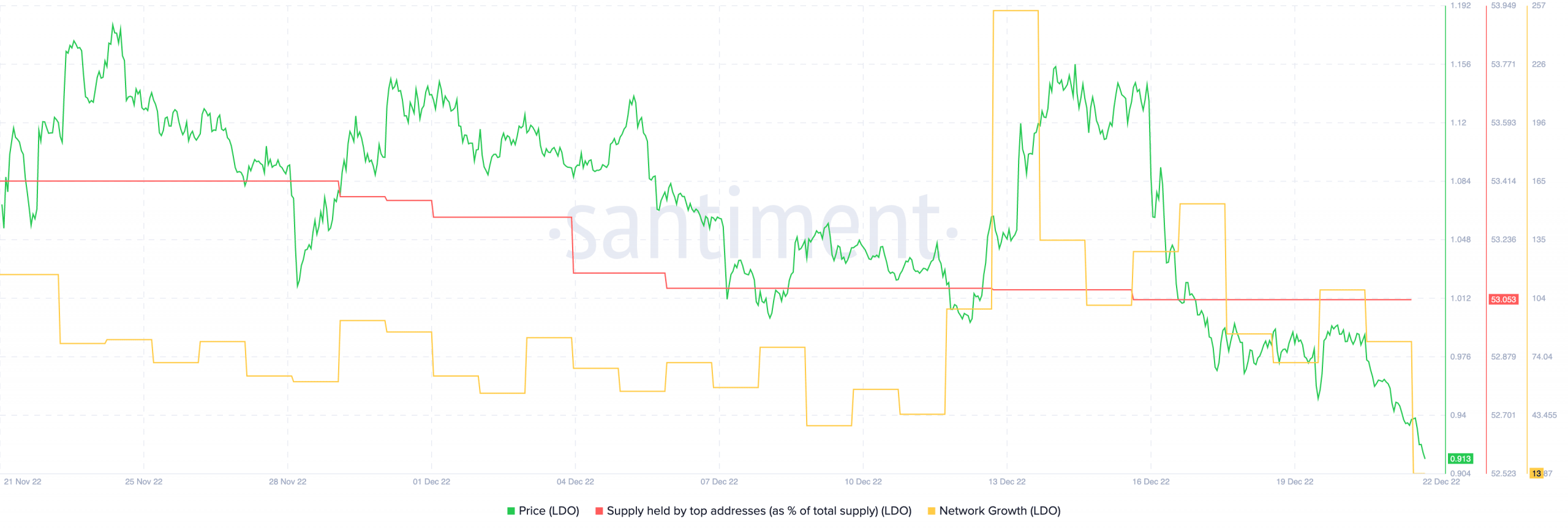

One consequence of the aforementioned developments could be a drop in interest from large addresses that held LDO.

As per data provided by Santiment, the percentage of LDO held by large addresses declined dramatically over the last month. This coincided with the drop in LDO’s prices, which could have been caused by the sale of LDO by large addresses.

Besides large addresses on the Lido network losing their confidence in LDO, new addresses too lost interest in the token.

How many LDOs can you get for $1?

This was evidenced by the declining network growth of the token, which decreased significantly over the past week. It suggested that the number of times new addresses transferred LDO for the first time had decreased.

However, it remains to be seen whether Lido Finance’s new updates can help the protocol overcome its problems.

At the time of writing, LDO was trading at $0.912. Its price had fallen by 4.93% in the last 24 hours, according to CoinMarketCap.