Why MicroStrategy and other institutions don’t regret their Bitcoin buys

It’s a good time to be a participant in the crypto-market. Not only did Bitcoin, the world’s largest cryptocurrency, hike to touch yet another ATH on the charts, but its market cap also breached the $1 trillion mark yesterday, a level that was unimaginable just over two months ago.

What has contributed to such a turnaround? Well, the answer isn’t limited to one factor alone. However, what has the biggest change over the last few months been? Perhaps, the answer is – Institutional investments.

Now, according to many, the flood of institutional investments we have seen recently is thanks to MicroStrategy announcing Bitcoin as its primary Treasury Reserve Asset back in August 2020. The “Michael Saylor Effect,” one newsletter called it. Ergo, it’s worth assessing if MicroStrategy, or the other public companies that put Bitcoin in their balance sheets, have any regrets.

After all, there were many who raised an eyebrow when MicroStrategy made its big Bitcoin decision. Huge risk, some said. Not befitting of the world’s biggest business intelligence company that is also publicly traded. For once, crypto-skeptics and market non-believers alike were united in their derision.

If @michael_saylor really wants to protect retained earnings from a decline in the value of the U.S. dollar, there are many other currencies Microstrategy can hold. If he's worried all fait currencies will lose value, he could hold #gold. There's no reason to gamble on #Bitcoin.

— Peter Schiff (@PeterSchiff) December 5, 2020

To consider and answer this question, Ecoinometrics’ Bitcoin Treasuries Index is a good place to start. The said index accounts for a significant number of the public companies holding the crypto-asset on their balance sheets. It includes the likes of MicroStrategy, Marathon Patent Group, Square, Riot Blockchain, and Tesla.

According to the same,

“…if an investor put capital in the Treasuries Index starting from the beginning of the 3rd halving, a nice 12x profit would be bankable in less than a year.”

Consider this too – While MSTR is up by 600%, Marathon is up by 5500%, and Riot blockchain is up by 3500%.

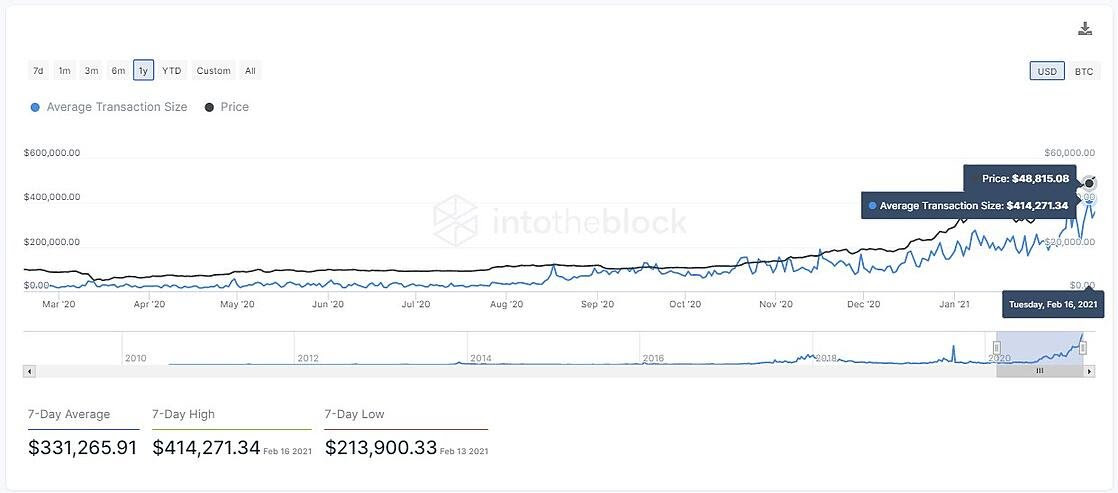

Here, it’s worth providing evidence for the assertion that it was MicroStrategy that truly opened the door for institutional investments in Bitcoin. For the same, the metric of Average Transaction Size is worth looking at.

The same hit a record-high of $440,000 a few days ago on the 16th of February. Incidentally, this was the same day as when MicroStrategy announced its plans to purchase more Bitcoin. In fact, the Average Transaction Size hiked by over 14% in the span of 24 hours.

Any doubts about whether MicroStrategy would get into Bitcoin again were laid to rest on the 16th after the firm announced that it would be offering $600 million worth of convertible senior notes to raise funds to buy more Bitcoin. It’s also worth noting that MSTR’s shares fell by a relatively insignificant 7% as soon as the news came to the fore, despite the fact that it was up by 5% in pre-market trading.

For many, however, the said depreciation was merely a blip, with most asserting that this was the development that finally pushed BTC past the $50,000-mark.

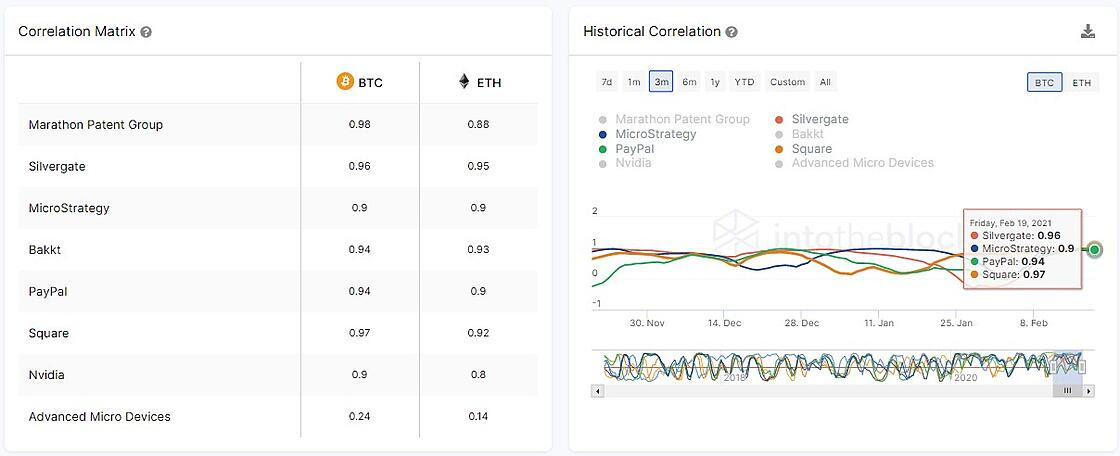

What’s more, of late, the 30-day correlation coefficient has highlighted a striking relationship between the world’s largest cryptocurrency and the aforementioned assets. The same was underlined by IntoTheBlock’s correlation matrix, with the same revealing that the likes of Marathon Patent Group, MicroStrategy, and Square all share a coefficient higher than 0.9.

Source: IntoTheBlock

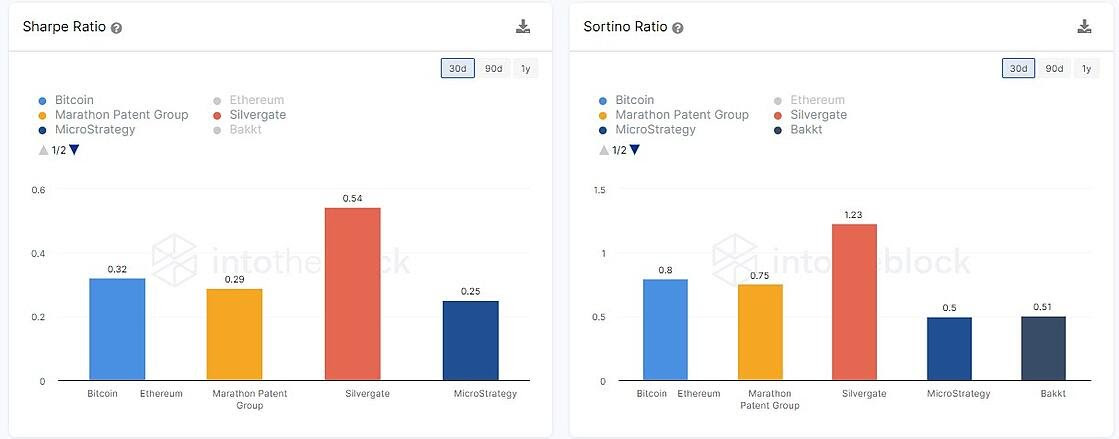

Other ratios seemed to be indicating something similar as well. In its latest newsletter, the crypto-analytics platform added,

“The similarities between Bitcoin and crypto-related equities are also visible in risk-adjusted indicators such as the Sharpe and Sortino ratio.”

The aforementioned ratios can be used to assess the performance of an equity investment, in this case, crypto-related equities, against risk-free investments.

The higher the Sharpe or Sortino Ratio, the better the risk-adjusted returns of the asset. According to IntoTheBlock, the likes of MicroStrategy and Marathon have both registered positive ratios on the aforementioned scale, with the same well in line with how well Bitcoin is doing.

Source: IntoTheBlock

Therefore, one can argue that while Bitcoin has surged on the charts, so have these companies. In fact, one can perhaps easily claim the opposite too, with the correlation between the two probably angling towards a relationship.

This leads one to the question – Who needs the other more, Bitcoin or Institutions? That’s a tricky question, but it can perhaps be best answered by this perspective,

“… institutions coming into Bitcoin might be old news now. Institutions adding Bitcoin to stay relevant, however, could be the next big narrative going forward.”