Reasons why ApeCoin [APE] token holders should be celebrating

ApeCoin has been subjected to a lot of volatility from the broader market since its launch. Even though investors’ interest in the token has dwindled in the past, it appears that now with an increasing number of token holders, APE will sail successfully through rough times.

Here’s AMBCrypto’s Price Prediction for ApeCoin for 2022-2023

As can be seen from the image below, the number of token holders grew tremendously over this year.

The cohort of token holders is divided and split into many terms. “Whales” are the token holders with huge pockets and investment capital, whereas “Krills” on the other hand, indicate regular retail investors.

The amount of Krills holding the ApeCoin token outgrew the number of whales.

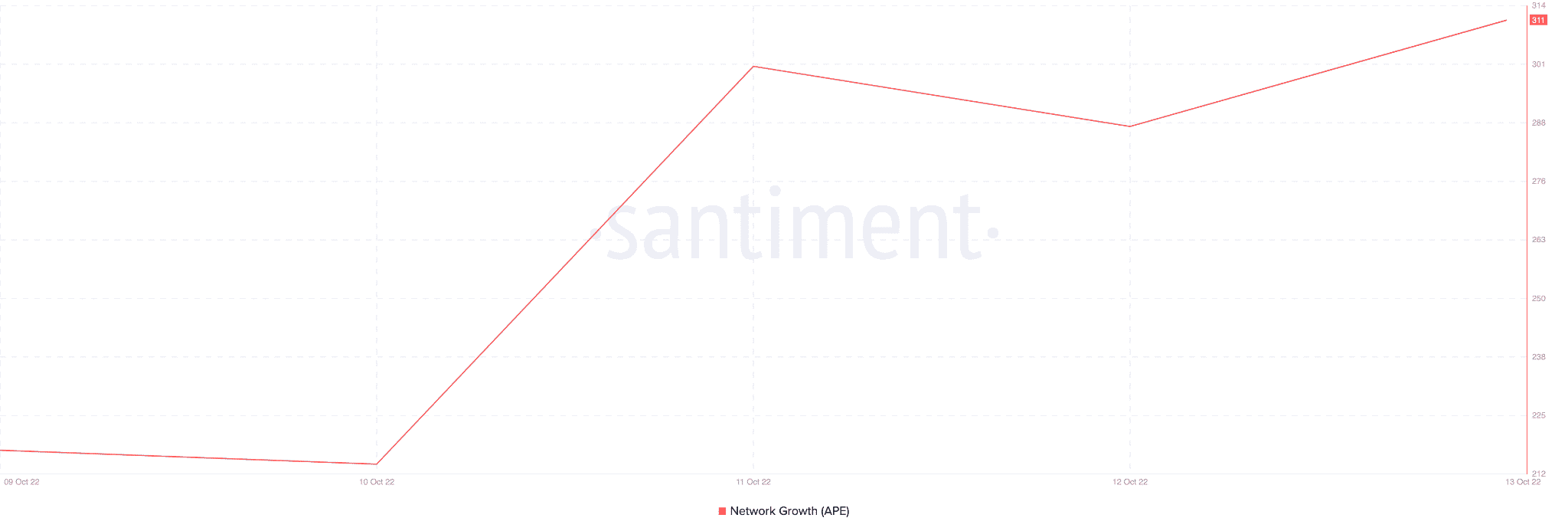

Along with the growth in the total number of token holders, there was a spike in ApeCoin’s network growth as well.

This implies that the number of new addresses that transferred ApeCoin for the first time increased. Thus, indicating that there was a renewed interest in APE by new addresses.

Some DAOts and concerns

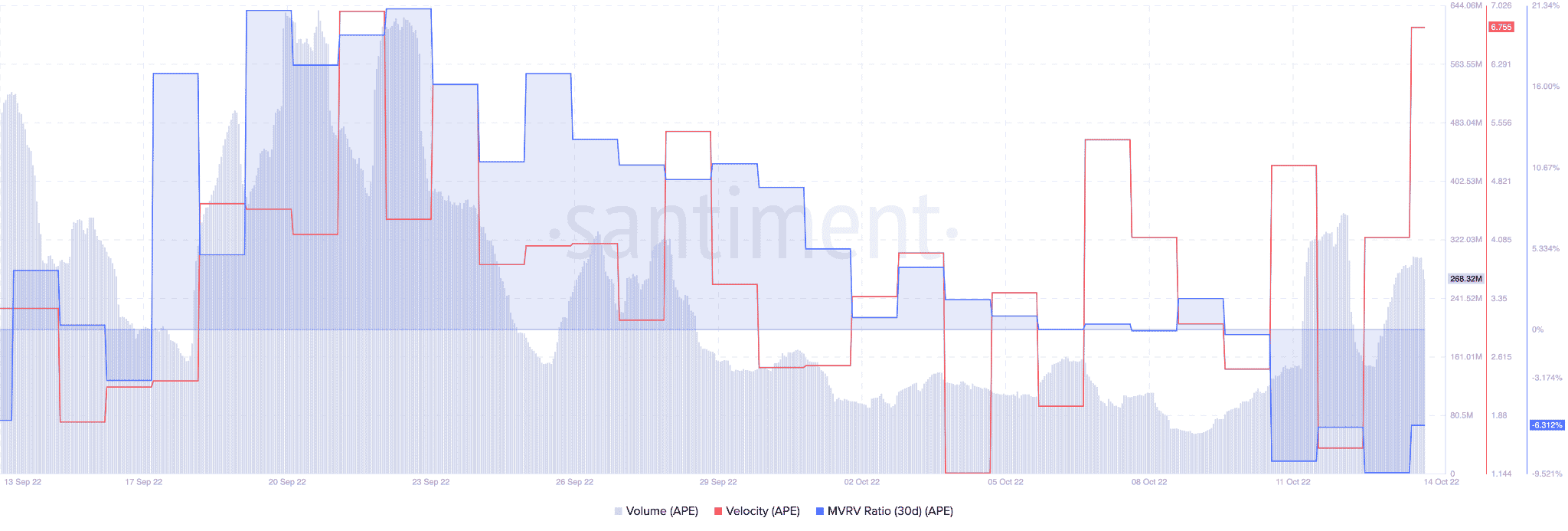

Even so, ApeCoin showed some bearish signs over the past month.

Its overall volume declined massively by 49.52% in the past 30 days. The MVRV ratio was also observed to be declining over the past few weeks indicating a possible bearish outlook for ApeCoin in the near future.

However, over the last couple of days, APE’s velocity witnessed a massive spike, indicating that the frequency with which ApeCoin was being transferred amongst addresses grew.

Another positive factor for APE holders was the decline in APE’s supply held by BAYC and MAYC owners. BAYC and MAYC owners still form a large part of the voting cohort due to the initial airdrop claim eligibility that the NFT owners received.

However, over time, their overall supply was observed to be declining which was another indicator of ApeCoin’s movement towards more decentralization.

That being said, at the time of press, APE grew by 5.67% over the last 24 hours and its volume increased by 41.90%. However, other assets in the Bored Ape community such as BAYC, observed a depreciation of 37.14% in their average price over the past week.